Saving money isn't always easy, but it's essential for achieving your financial goals. By implementing some simple strategies, you can increase your savings potential and achieve yourself up for a secure future. To begin, create a detailed budget that tracks your income and expenses. This will help you to identify areas where you can reduce spending and redirect more funds towards savings.

Furthermore, consider different saving options, such as high-yield savings accounts, certificates of deposit (CDs), or money market accounts. These options typically give higher interest rates than traditional savings accounts, enabling your money to expand faster.

, Equally important, establish a savings target and commit to it. Having a clear goal in mind will drive you to save consistently. In conclusion, remember that saving is a continuous process. Even small, consistent contributions can accumulate over time and make a significant difference in your financial well-being.

Budgeting Hacks You Need to Know!

Are we ready to become a money-saving superstar? It's time to ditch those costly habits and embrace ingenious strategies that will have your bank account singing. First, let's tackle those hidden expenses in your budget. Track how you spend for a couple of weeks and identify spots where you might cut back. Consider making a packed meal instead of eating on the go, which can seriously drain your funds. Don't forget to compare before making purchases. There are always better options out there if you take the time.

- Furthermore, remember to discuss bills with service providers. You might be surprised at what it's possible to reduce.

- Lastly, don't forget the power of waiting gratification. Resist spending sprees and consider before making any luxury expenses.

Conquer Inflation with Smart Spending Habits

Inflation can severely impact your finances, making it harder to attain your financial goals. But don't fret! By implementing a handful of smart spending habits, you can savvy savings video effectively combat the effects of inflation and preserve your purchasing power.

Start by developing a detailed budget that monitors your income and expenses. Pinpoint areas where you can trim spending without sacrificing your quality of life. Consider alternatives to high-priced items or options.

Next, focus on saving and investing. Even minor contributions can accumulate over time, helping you weather economic downturns. Research different investment vehicles to find suitable ones that align with your risk tolerance.

Finally, stay updated about current economic conditions and adjust your spending habits appropriately. By staying proactive and adopting these smart spending strategies, you can successfully conquer inflation and safeguard your financial future.

Master Your Finances: A Guide to Savvy Saving

Take control of your financial future by embracing the science of savvy saving. It's not about reducing everything you enjoy, but rather adopting strategic choices that optimize your savings potential. By developing a budget, pinpointing areas where you can trim expenses, and setting clear savings goals, you can shift your financial situation from fragile to solid. Remember, every cent saved is a step closer to achieving your dreams.

Here are some fundamental tips to get you started:

* Order your spending and pinpoint areas where you can trim expenses.

* Establish a realistic budget that distributes funds for both needs and wants.

* Establish specific, measurable savings objectives to stay inspired.

* Investigate different savings alternatives like high-yield savings accounts or certificates of deposit.

* Automate your savings by setting up regular transfers from your checking to savings account.

By implementing these approaches, you can master your finances and pave the way for a prosperous future.

Maximize Your Savings with These Savvy Strategies

Ready to rock your financial goals? It's time to level up your savings game! Whether you're aiming for a dream vacation, a down payment on a home, or simply want to build a solid financial cushion, these expert tips and tricks will help you achieve financial freedom.

- Start small

- Schedule regular deposits

- Maximize your returns

- Live more frugally

- Negotiate bills

With a little effort, you can revolutionize your savings habits and pave the way to a brighter financial future. Get started today and watch your savings multiply!

From Paycheck to Piggy Bank: Your Journey to Financial Freedom

Tired of living paycheck to paycheck? It's time to take control of your finances and pave the way to real financial freedom. This journey is not about overnight riches, but rather a gradual shift in mindset and approach. Start by monitoring your spending, creating a budget that fits your needs, and setting realistic objectives. Remember, every small step you take brings you closer to achieving your dreams.

- One powerful tool is automating your savings – set up regular transfers from your checking to your savings account.

- Putting your money wisely can help it multiply over time.

- Don’t be afraid to seek expert advice from a financial advisor who can assist you on your path to success.

Financial freedom is within reach. Take the first step today and begin cultivating a brighter financial future for yourself.

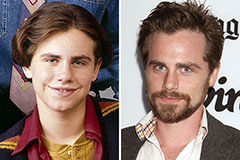

Rider Strong Then & Now!

Rider Strong Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Nadia Bjorlin Then & Now!

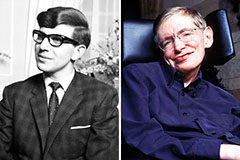

Nadia Bjorlin Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!